Car depreciation calculator percentage

We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time. The Car Depreciation Calculator uses the following formulae.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

. So 11400 5 2280 annually. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Cars With the Lowest Depreciation Rate.

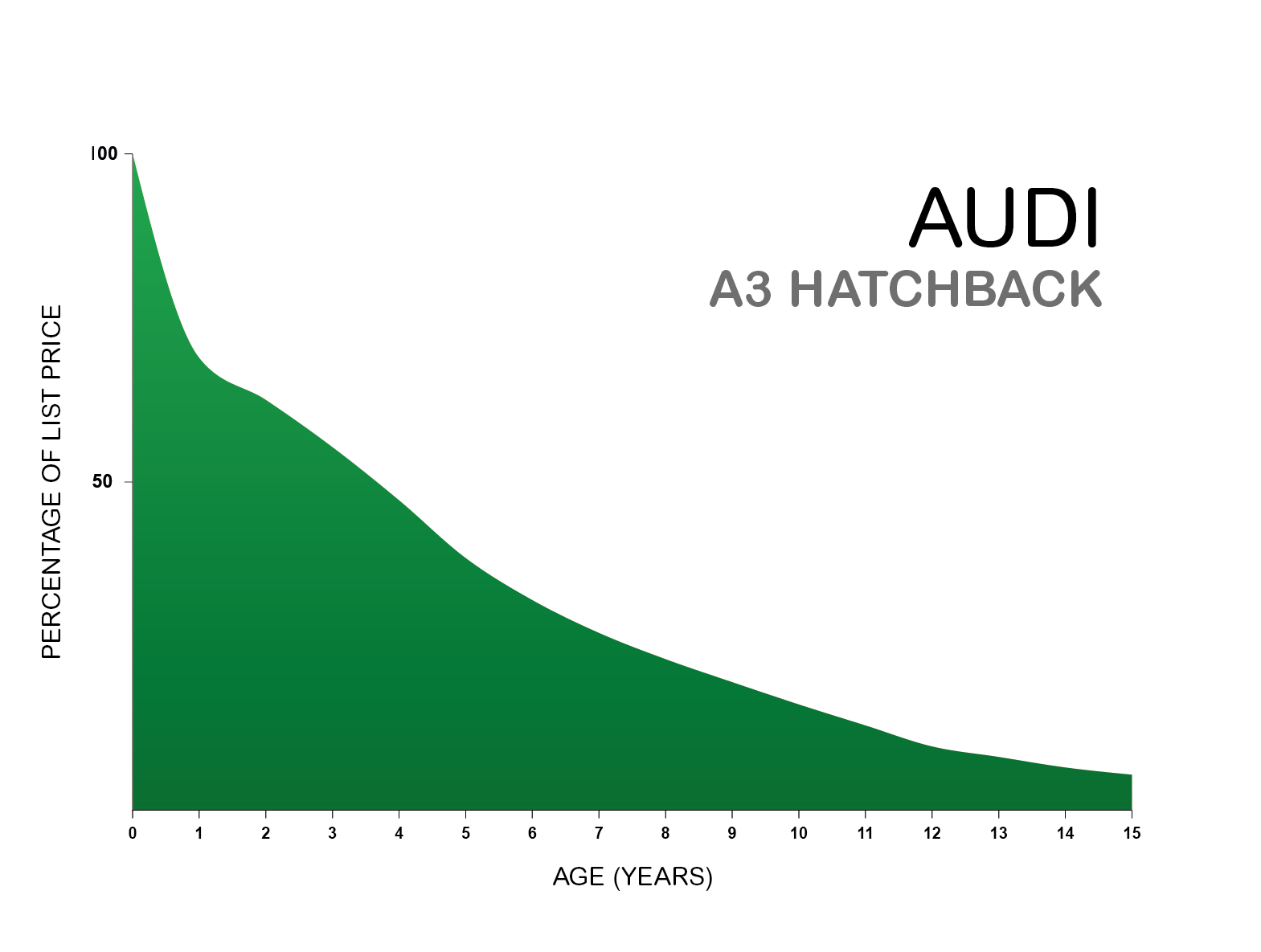

After two years the value of your car declines by 69 percent. We have also built historical depreciation curves for over 200 models many of which go back as far as 12. Feel free to change the rates as you see fit.

Baca Juga

D P - A. Then the value of the car continues to decline year after year. Jen enters the cars year make and model into the AutoPadre car depreciation calculator.

Section 179 deduction dollar limits. Number of years car used n. Abarth 25 average 3 year depreciation Alfa Romeo 55 average 3 year depreciation.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Select a Vehicle MakeManufacturer from below to see all models we have data for.

Online Depreciation Calculators includes Car Depreciation Calculator MACRS Depreciation Calculator Depreciation Comparison Calculator Percentage Depreciation Calculator and more. Depreciation rate in percentage r. Initial Cost C.

Using the Car Depreciation calculator To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. Note that the figure entered in Year 10 will be. Your cars value drops to 81 of its original cost after a year.

Under this method the calculation of depreciation is based on the fixed percentage of its cost. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15 300 Step two - Subtract depreciation charge from current asset value to get the remaining balance Balance 3000 - 300 2700. To calculate the depreciation of your car you can use two different types of formulas.

Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. Car Depreciation Calculator.

The calculator predicts that after 5 years the 2017 Corolla will have depreciated just 13 1706. Existing Navy Federal loans are not eligible for this offer. Prime Cost Method for Calculating Car Depreciation.

Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims. The ad lists the car for 12000. Knowing which cars have the lowest depreciation rate can help you decide which vehicle will hold its value the longest.

Buy a car for 10000 and it might cost you 2000year in deprecation and be worth around 4000 after three years but spend 50000 and the bill for depreciation will be more like 10000 per year. The following values source are used in our car depreciation calculator. The following chart contains the default year-to-year depreciation rates used by the Car Depreciation Calculator.

To calculate the used cars value we need certain input variables that have been given below. The formula for depreciation goes like this. Diminishing Value Method for Calculating Car.

To calculate the used cars value we need certain input variables that have been given below. A C times 1 fracrn100 Advantages of Using the Car Depreciation Calculator. Depreciation Amount Asset Value x Annual Percentage Balance Asset Value - Depreciation Value You may also be interested in our Car Depreciation Calculator or MACRS Depreciation Calculator Currently 4045 1 2 3 4 5.

We will even custom tailor the results based upon just a few of your inputs. While the percentage drop may be similar the actual cost of deprecation clearly varies hugely between a small cheap car and an expensive luxury car. A C 1 r n 100 A C times 1 dfracrn100 A C 1 1 0 0 r n How to calculate vehicle depreciation.

Initial Cost C C C. 309 of value lost. You can then calculate the depreciation at any stage of your ownership.

This compares favorably to a used 2020 Corolla which along. Loan must be open for at least 60 days with first scheduled payment made to be eligible for the 200 which will be credited to the primary applicants savings account between 61 and 65 days of. The average car depreciation rate is 14 per year.

You can use low medium or high depreciation rates or. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. You can choose High Medium or Low clicking a second time restores the defaults or manually change each years rate enter as percentages so for 28 enter 28.

Auto refinance loan must be at least 5000. Calculate Car Depreciation By Make and Model Find the depreciation of your car by selecting your make and model. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Cars lose about 58 percent of their worth after three years. A P 1 - R100 n. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

If you leave the Depreciation period field empty the car depreciation calculator will output the depreciation over the next 8 years. 1 Credit and collateral subject to approval. Depreciation rate in percentage r r r.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Number of years car used n n n. The formula for depreciation goes like this.

Jen figures on driving about 12000 miles a year so she selects 12000 miles from the dropdown.

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator Depreciation Of An Asset Car Property

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Calculator Property Car Nerd Counter

Car Depreciation Rate And Idv Calculator Mintwise

Sum Of Years Depreciation Calculator Template Msofficegeek

Depreciation Calculator Apps On Google Play

Depreciation Of Car Word Problem Solution Youtube

Free Macrs Depreciation Calculator For Excel

Car Depreciation Calculator

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Calculator Per Year Calculator Academy

Car Depreciation Explained With Charts Webuyanycar

Depreciation Rate Formula Examples How To Calculate